Single parents can now get assistance to buy the family home

Australia has more single-parent households than ever before. And at the same time, home ownership rates for single parents have decreased.

The Australian Government’s Home Guarantee Scheme (replacing the First Home Loan Deposit Scheme) is designed to address this challenge, expanding to include multiple groups including single parents.

Have a 2% deposit? The Government will guarantee the rest

If you’re a single parent looking to buy a family home, see if you’re eligible for the First Home Guarantee.

Why single parents in Penrith need help to get (back) into the housing market

In 2007-08, 42% of single-parent households were renting. Ten years later, that figure had increased to 47%[1].

Why? Since the 1970’s we’ve seen a growth in single parent households. The associated economic constraints that come with a single income has been a significant factor in the decline of home ownership rates for single parents[2], and this is reflected most clearly in Penrith.

Comparing the families with children in Penrith in 2021 to Greater Sydney, the Penrith City Council community profile highlights that Penrith has:

- A larger proportion of single parent households with children under 15 (4% compared to 3.4%), and

- A larger proportion of single parent households with older children (15+): 8% compared to 5.9%.

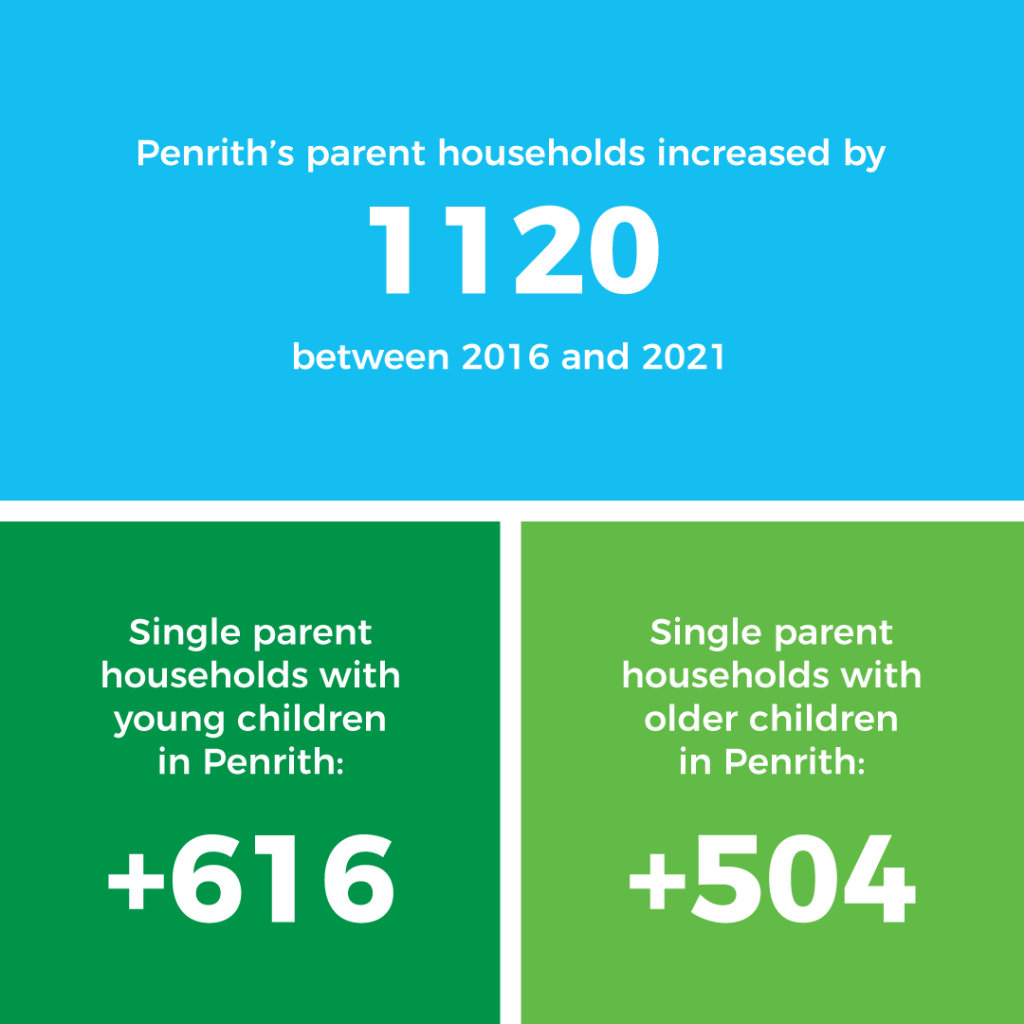

The increase in Penrith’s single parent households between 2016 and 2021

Why single parents are most vulnerable – and how to get help securing a mortgage

Many single parents have transitioned from home ownership to rental, with increasing house prices and the corresponding deposit required presenting a major barrier to re-entering the market.

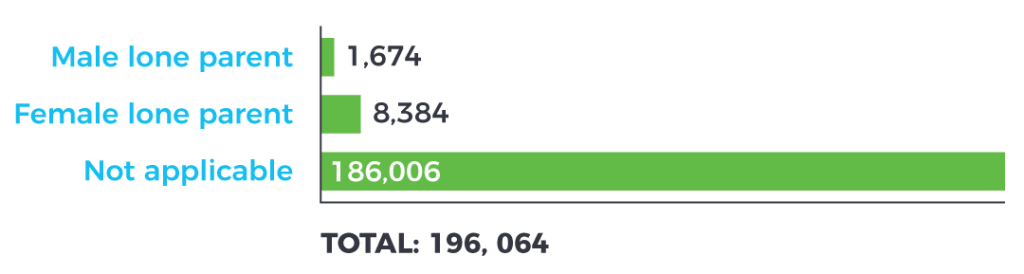

This is compounded for women who, as Penrith’s numbers indicate, are more likely to have responsibility for dependants. Research also shows that the national wage gap (currently 14.1%) makes it even more difficult for women to save for a house deposit compared to men[3].

Reversing the decline in home ownership for single parents, particularly in Penrith

Nationally, it’s hoped some of these barriers will be reduced with the introduction of the Family Home Guarantee.

Designed to help single parents with dependants (who are predominantly women) to buy a family home, the Scheme:

- Recognises the stress that can result from moving from a dual to single income, and

- Acknowledges the immediate and long-term negative effects of insecure housing on both adults and children.

What’s the Family Home Guarantee all about?

The Family Home Guarantee:

- Is administered by the National Housing Finance and Investment Corporation on behalf of the Australian Government

- Supports single parents with at least one dependent child to enter (or re-enter) the housing market sooner, and

- Can be used to purchase an existing home or building a new home.

There are 5,000 Family Home Guarantee

places each financial year

until 30 June 2025.

How does the Family Home Guarantee Scheme work?

The National Housing Finance and Investment Corporation guarantees up to 18% of the property value. This enables eligible single parents to purchase a home:

- With as little as a 2% deposit, and

- Without the required Lenders’ Mortgage Insurance.

Loans must be provided by a participating lender (to find out which lenders are involved, talk to us).

Until 30 June 2025, 5,000 places a financial year have been allocated to support eligible single parents with at least one child to re-enter the market.

Want to know your borrowing power?

Use our Property Buying calculator to find out your borrowing capacity.

Am I an eligible single parent for the Family Home Guarantee Scheme?

A high-level look at the eligibility criteria for the Family Home Guarantee includes:

- You must be an Australian citizen

- You must be a single parent with at least one dependent child

- You must be the only name listed on the loan and the certificate of title

- You must have a deposit of between 2% and 20% of the value of the property you wish to purchase and able to service the loan

-

You must be purchasing:

• An established dwelling

• A house and land package

• Land and separate contract to build a home

• ‘Off the plan’ - You must ensure the costs to purchase and/or build are within the property price cap for your area (capital cities and regional centres vary to the rest of State)

- You must live in the property you purchase as an owner-occupier for the entire period the home loan is guaranteed under the Scheme

- You must be 18 years or over

- You must not be a permanent resident

- You must not be married or in a de facto relationship (being separated but not divorced is not considered to be single)

- You must not currently own land or a home in Australia (although you can have owned a home before)

- You must not have earned more than $125,000 in the previous financial year (child support payments are not included)

- You must not have a deposit less than 2%, or more than 20%, of the value of the property you wish to purchase

- You must not be taking a new loan to build on vacant land you already own

- You must not have an owner builder contract (if building) – they aren’t eligible under the Scheme

- You must not exceed the property price cap for homes in your area for either your purchase price, or your purchase price and construction costs (capital cities and regional centres vary to the rest of State)

- You must not purchase/build an investment property

- You must not have any legal action being taken against you

How to buy your home with a 2% deposit – the Fact Sheet and Information Guide for single parents

Single parent in Penrith? We’ll help you apply

There are just three simple steps.

1. Make sure you’re eligible

Check your eligibility (the ticks and crosses above).

Got questions? Give us a call, we’re happy to talk you through it.

2. Apply for conditional approval

Book an appointment with Penrith’s best team of mortgage brokers (and no, we’re definitely not biased!).

We’ll help you apply and, following conditional approval, will reserve your place in the Scheme.

3. Build or buy your family home

Your family’s future starts today – build the life you want in the home you’ll love.

Whether you choose to buy an existing property or build a new home, the future is yours.

If you’re ready to get started, we’re ready to help

With numbers capped at 5,000 per financial year, give us a call.

Taking with Educated finance is obligation and pressure-free – it’s just an opportunity for you to:

- Identify the support you’re eligible for as a single parent

- Confirm your eligibility against the criteria

- See the various rates, features and fees of the approved lenders (we’ll analyse and identify the best option for your needs)

- Get help working out your repayment capacity, and

- Get help from our mortgage brokers with a plan to move forward.

Single parenting is a tough gig, which is why we’re genuinely committed to helping you make the most of every opportunity to get into – or back into – the property market.

Don’t go it alone. For support from beginning to end, talk to an Educated Finance broker today.