How single parents, first home buyers, and buyers in regional areas can purchase property with a smaller deposit

With more incentives available for home buyers than ever before, here’s how to take the sting off entering (or re-entering) the housing market

Hands up if you read the 2022-23 Federal Budget? Don’t worry – we took one for the team and read it for you. 😉

The good news for those looking to buy a home is that there are more incentives and support available than ever before. The bad news? We’re seeing increased confusion and overwhelm for some looking to enter the market, while a considerable number of potentially eligible buyers aren’t even aware of the expanded options.

To avoid over-complicating it, we’re breaking the various schemes down in a series of blogs. This first one focuses on the new Home Guarantee Scheme, which expands beyond first home buyers. So, if you’re wanting to get into the property market sooner, now’s your chance.

Got a smaller deposit but want to enter the property market now? Find out how to secure the additional support available for first-home buyers, single parents and regional Australians

But first, a few fast facts for context

Way back in 2020…

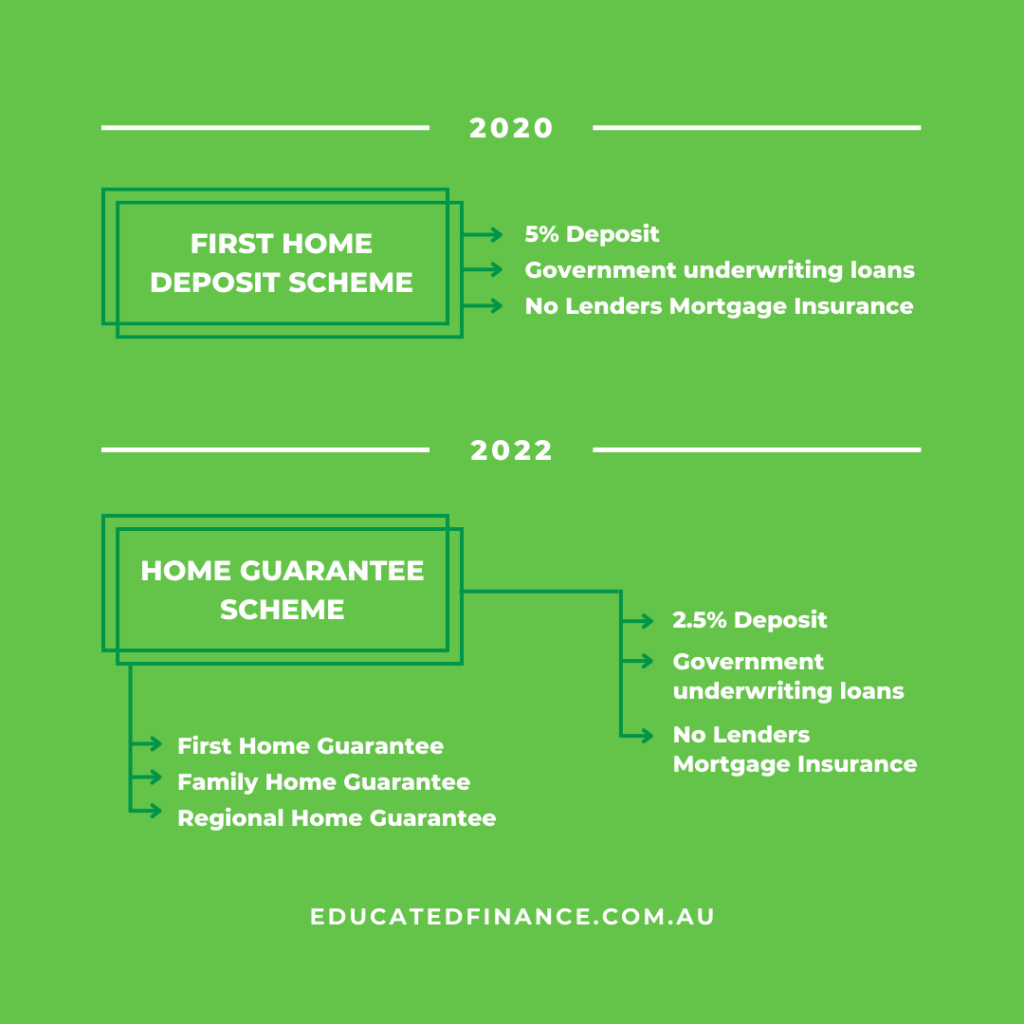

On 1 January 2020, the government introduced the First Home Loan Deposit Scheme. The goal was to support more eligible first home buyers to purchase their first home sooner.

Administered by the National Housing Finance & Investment Corporation (NHFIC), the Scheme:

- Was available to 25,000 first home buyers a year

- Reduced the required deposit to 5%

- Established a panel of participating lenders, and

- Saw the NHFIC guarantee up to 15% of the value of the property purchased that is financed by an eligible first home buyers’ loan to those lenders. This removed the Lenders Mortgage Insurance (LMI) costs ordinarily required for deposits less than 20% of the value of the property.

Then in 2022…

As part of the 2022-23 Federal Budget, the First Home Loan Deposit Scheme was expanded to offer further support. To reflect this, it’s now known as the Home Guarantee Scheme.

How the Home Guarantee Scheme is different from the First Home Loan Deposit Scheme

The main changes are:

- From the 2022-23 financial year, the number of guarantees under the Home Guarantee Scheme has been increased to 50,000 guarantees a year for the next three years.

- Following the set three-year period, the guarantees will reduce to from 50,000 to 35,000 per year.

- The Scheme expands beyond first home buyers – it also provides specific support opportunities to buyers in regional locations and single parents looking to re-enter the market.

- Unlike the First Home Loan Deposit Scheme, eligible buyers can choose to purchase an established home or build a new home.

What does the Home Guarantee Scheme look like?

The Home Guarantee Scheme encompasses three types of guarantees:

- The First Home Guarantee (formerly the First Home Loan Deposit Scheme)

- The Family Home Guarantee, and

- The Regional Home Guarantee.

How the numbers are allocated

First Home Guarantee:

The previous 25,000 guarantees available to eligible first home buyers increased to 35,000.

Family Home Guarantee:

Until 30 June 2025, 5,000 places a year have been allocated to support eligible single parents with at least one child to re-enter the market.

Regional Home Guarantee:

Until 30 June 2025, 10,000 places a year have been allocated to support eligible buyers purchasing a new home in a regional location.

Maximum purchase prices

If you’re thinking about refinancing your mortgage, get in touch with us. We can help you understand your options and find the right lender and loan product for your situation.

Tip: Search for the property price threshold via suburb or postcode with this nifty tool.

Am I eligible? Support for first home buyers looking to build or buy

Relevant scheme for first home buyers: First Home Guarantee.

Eligible property types: New and existing homes (the scheme specifically defines what constitutes ‘an eligible residential property’ – we’ll talk you through it).

Buyer eligibility: You’ll need to be a first home buyer with a deposit of at least 5% of the property value (as assessed by your lender).

Income cap: The Guarantee is subject to an income cap of $125,000 for singles and $200,000 for couples (must be married or de-facto).

Availability: Opens 1 July 2022, with 35,000 places available to or before 30 June 2023.

Am I eligible? Support for single parents looking to build or buy

Relevant scheme for single parents: Family Home Guarantee.

Eligible property types: New and existing homes (as above, the scheme specifically defines what constitutes ‘an eligible residential property’ – we’ll talk you through it).

Buyer eligibility: You’ll need to be a single parent with at least one dependent child. The minimum deposit you’ll need is at least 2% of the property value (as assessed by your lender).

Income cap: The Guarantee is subject to an income cap of $125,000.

Availability: Opens 1 July 2022, with 5,000 places available to or before 30 June 2023.

Am I eligible? Support for home buyers in regional areas

Relevant scheme for home buyers in regional areas: Regional Home Guarantee.

Property type: New residential homes (as above, we’ll talk you through what the scheme defines as an ‘eligible residential property’).

Eligibility: You’ll need to be a home buyer that’s purchasing a new home in a regional location and has been out of the market for five or more years. You’ll need a deposit of at least 5% of the property value (as assessed by your lender).

Income cap: The Guarantee is subject to an income cap of $125,000 for singles and $200,000 for couples.

With the current assistance packages providing a genuine advantage, now is the time to buy

Just because the housing market has become more inaccessible doesn’t mean it’s impossible for first home buyers and single parents rebuilding their lives to purchase property.

We’ve only covered the First Home Guarantee Scheme here, but there are plenty of others that will also save you tens of thousands on your mortgage. There’s nothing worse than sticking your head in the sand to plough away at your deposit only to later discover that you did have enough to secure a loan.

There’s a lot of information out there, but if you’d like advice about the support you’re specifically eligible for, give us a call. It’s completely obligation-free and no hard sell, we promise.

We’re ready to help

The long and short of it? You never know unless you ask. With limited numbers available, today is the day to get help with:

- Understanding the extensive support schemes available

- Identifying how they may change your borrowing needs

- Working out your repayment capacity

- Identifying the best loan (rates, features & fees) from the approved lenders

- Applying for and managing your government support and loan,