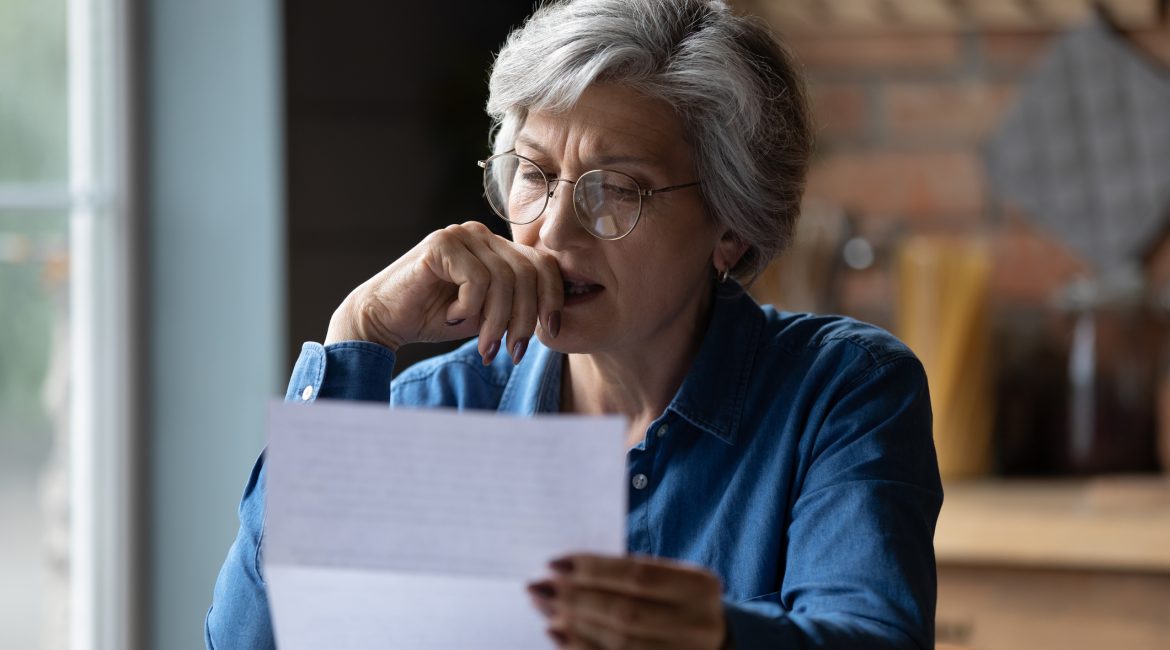

Just what does go into calculating a mortgage?

Understanding the mortgage costs is crucial if you’re in the market for a new home.

Our own Matthew Townley-Jones shares his expert insight in a Supermoney article exploring:

- The factors that influence your mortgage repayments; and

- How to make informed decisions.

… if you’ve had an unpaid or paid default, you’ll likely have a low credit score and therefore be less likely to be able to apply to a mainstream lender. You may need to apply to a non-bank lender, which likely will have higher interest rate and fees.”

The article covers everything from interest rates and deposits to loan terms and private mortgage insurance (PMI). Whether you’re a first-time buyer or looking to refinance, this article provides valuable information to help you navigate the mortgage landscape.

Ready to get the full breakdown? Read the full article and take the first step towards securing your dream home.

By understanding these key factors, you can better prepare yourself for the financial responsibilities of homeownership. Don’t miss out on Matthew’s expert advice—it’s a must-read for anyone serious about buying a home.

Considering applying for a home loan? Reach out to Educated Finance.

Call 1300 338 228 and take up opportunities today with the team that’s also with you for tomorrow.